In some countries, it is mandatory for companies to manage their purchase accounts. However, configuring purchase accounts is also considered good practice, as it can lead to more effective financial statements. This, in turn, can help companies better address audit compliance requirements.

Features

Purchase accounts can be updated in the following ways:

At the receipt value

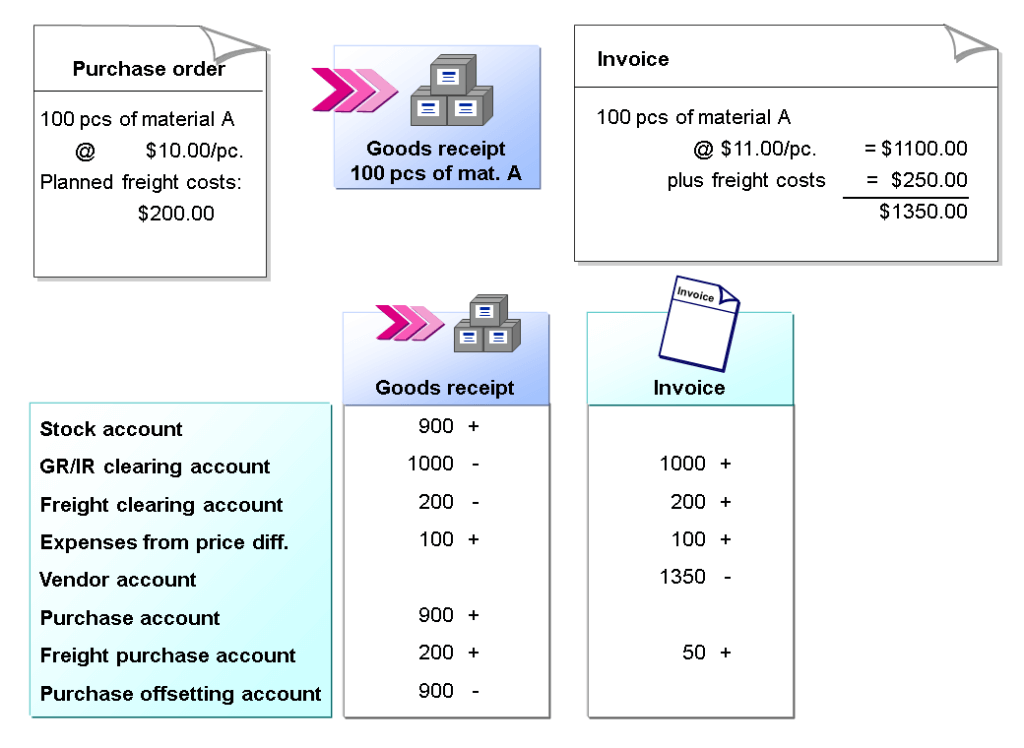

In this scenario, the amount that is recorded in the GR/IR clearing account at the time of goods receipt is also recorded in the purchase account without any discrepancy.

During the process of Invoice Verification, the system will only make a posting to the purchase account in the event that there is a difference in price. When a price difference occurs, the system will make two postings: one to the stock account and another to the price difference account. The total of these two postings will then be posted to the purchase account.

Purchase : Postings at Receipt Value

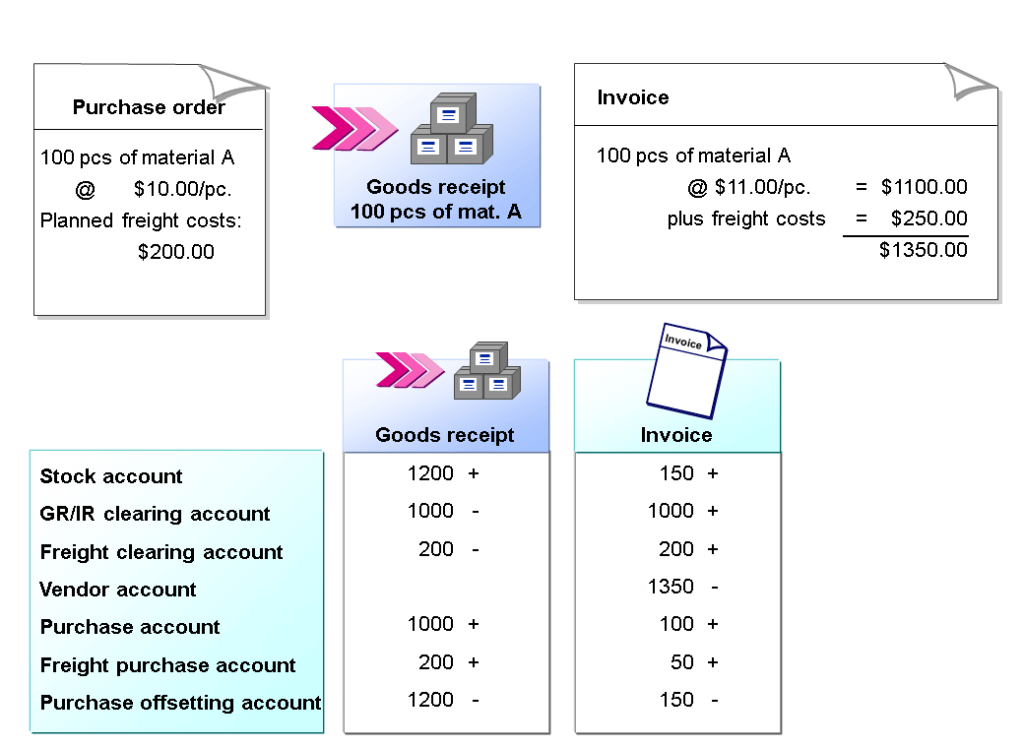

At the stock value

In this case, the exact amount posted on the receipt of the goods or on the invoice receipt will be effectively posted to the purchase account.

- In Invoice Verification, the system posts to the stock account, purchase account, and purchase offsetting account only if the invoice item meets specific conditions.

- A Price variance has occurred.

- The material’s price can be controlled by using the moving average method.

- There is stock available for the material.

Similar to the purchase account, a freight account exists for documenting delivery costs that have been posted for externally procured materials.