A company’s chart of accounts (COA) is a list of all the financial accounts in the company’s general ledger.

The process of combining accounting data into a standardized set of financials is necessary for the preparation of financial statements.

Companies manage their finances using a chart of accounts (COA) and assisting in the accomplishment of this goal and ensuring that all financial statements are in accordance with applicable reporting standards.

Financial statements

Financial statements can be broken down into the following categories: the Balance Sheet, the Income Statement, and the Cash Flow Statement. Such documentation makes it possible to examine and evaluate several aspects of an organization’s financial health and performance.

- Balance Sheet: To see the company’s assets and liabilities : Assets = Equity + Liabilities

- Income statement: Simply, A Profit and loss account is a record of a company’s revenues and expenses for a specific period of time : Profit & Loss = Revenue – Expense

- Cash flow statements: To illustrate the actual cash flow Operating + Investing + Financial Activities ( Direct and Indirect Method )

Chart of Accounts (COA) – Design Tips

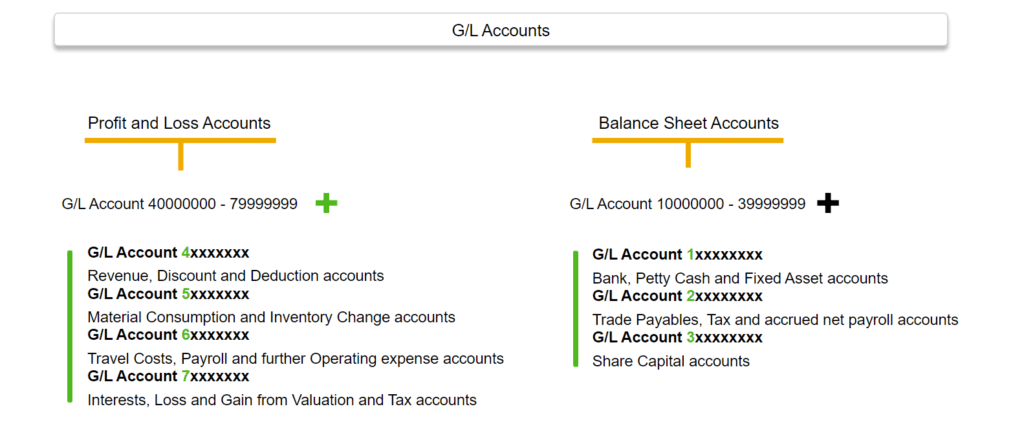

A standard procedure among businesses is to assign sequential numbers to each account type used in their financial statements.

SAP account numbers : The maximum length is ten characters

This numbering scheme makes it simpler for bookkeepers and accountants to keep track of the postings made to the accounts ledger in an efficient manner.

Example : 6 Digits concepts

- Assets: 1 XX XXX

- Liabilities: 2 XX XXX

- Owners Equity: 3 XX XXX

- Revenues: 4 XX XXX

- Expenses: 5 XX XXX

- Others : 6 XX XXX and 7 XX XXX

Chart of Account : Balance sheet + Profit & Loss

Another Example : 6 Digits concepts – Categorized based on Account types

Balance Sheet :

Assets ( Non Current (>12) + Current (<12) )

= Equity + Liabilities ( Non Current (>12) + Current (<12) )

Non Current Assets :

- Intangible Assets :11 X XXX

- Other Tangible Assets : 12 X XXX

- Land & Buildings : 13 X XXX

- Equipment and Machinery ( Operational ) : 14 X XXX

- Property, plant, and equipment (PP&E) : 15 X XXX

- Other Financial Assets : 16 X XXX

Current Assets :

- Inventory : 21 X XXX

- Trade Receivables : 22 X XXX

- Cash at Banks : 23 X XXX

- Petty Cash : 24 X XXX

- Other Current Assets : 25 X XXX

Equity :

- Issued Capital : 31 X XXX

- Reserves : 32 X XXX

- Revenue Reserves : 33 X XXX

- Accumulated other comprehensive income : 34 X XXX

Non Current liabilities :

- Long-term provisions : 41 X XXX

- Deferred Tax Liabilities: 42 X XXX

- Long-term Financial Liabilities: 43 X XXX

Current liabilities :

- Short-Term Provisions: 44 X XXX

- Trade Payables: 45 X XXX

- Tax Payables: 46 X XXX

- Tax Provisions ( like Income Tax ) : 47 X XXX

- Other Current Liabilities : 48 X XXX

- Current Financial Liabilities : 49 X XXX

Profit and Loss Statements :

Profit & Loss = Revenue – Expense

Revenue :

Sales Revenue : 51 X XXX

Sales Deductions : 52 X XXX

Other Sales Transactions ( Scrap and etc. ) : 53 X XXX

Other Operating Income :

Other Operating Income : 59 X XXX

Cost-reducing Revenue – Operational

Finished Goods – Change In Inventory ( stock change account )= 54 X XXX

Cost-reducing Revenue – Others

Purchase Accounts (Direct ) : 61 X XXX

Purchases other charges ( Freight / Clearing , etc..) : 62 X XXX

Material Consumptions : 63 X XXX

Cost of Goods Sold : 64 X XXX

Raw Material – Change In Inventory – 64 X XXX

Others – Material Loss/Physical Inventory – 65 X XXX

Expense

Wages Operational ( Direct ): 71 X XXX

Salaries : 72 X XXX

Social Contributions : 73 X XXX

Other Personnel Costs: 74 X XXX

Administrative Expense : 75 X XXX

Promotional Expense : 76 X XXX

Information Technology Expense : 77 X XXX

Other Operational Expense : 78 X XXX

Depreciation and Amortization – Depreciation Expense : 79 X XXX

Financial Income and Expense

Financial Income :81 X XXX

Financial Expense :82 X XXX

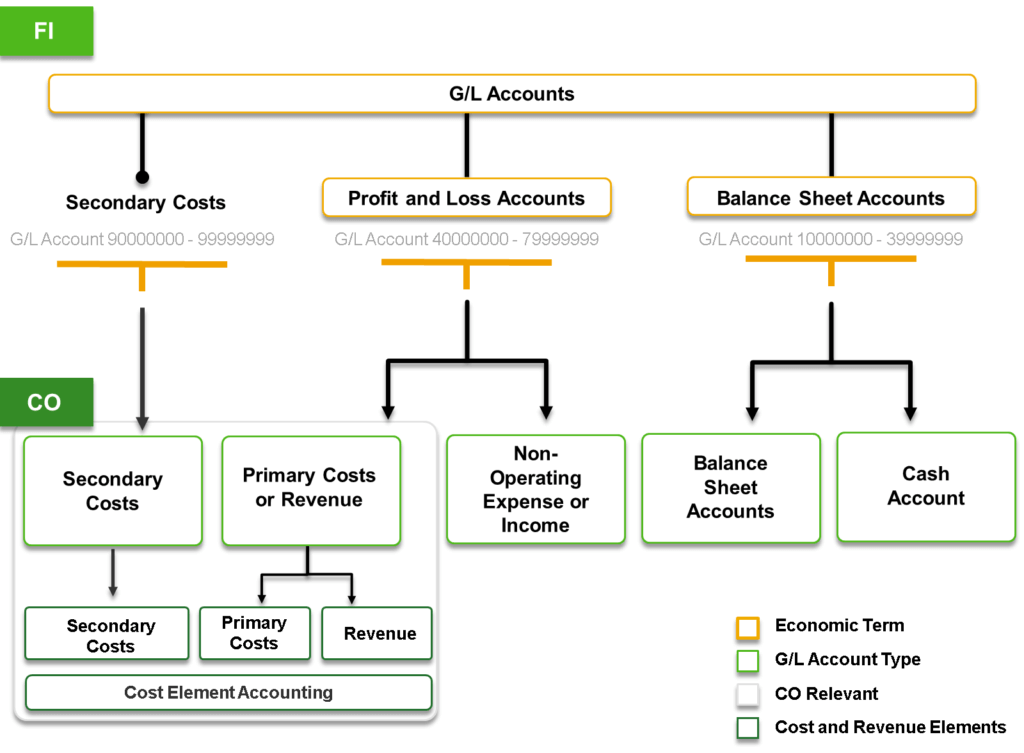

Others

Secondary Costs : 9XX XXX

- Operation costs not part of financial general ledger posting and used for cost module.

Opening Balance : 99X XXX

- Initial Upload during system conversation