Having a clear understanding of fixed assets and their distinction from other warehouse goods is crucial for comprehending your accounting procedures. A fixed asset, often known as a capital asset, is property, plant, or equipment (PP&E) you own or manage to create revenue.

You can think of fixed assets as things that your business won’t consume, sell, or liquidate over the next 12 months. Fixed assets are not the same as current assets, which are liquid or will be liquid within a year.

Features

The Asset Accounting component consists of the following parts:

- Basic functions:

- Master data (asset maintenance)

- Basic valuation functions

- Depreciation

- Transactions, such as asset acquisitions and retirements

- Closing operations

- Special valuations: for example, for investment support.

- Preparations for consolidation for group financial statements.

- Information system.

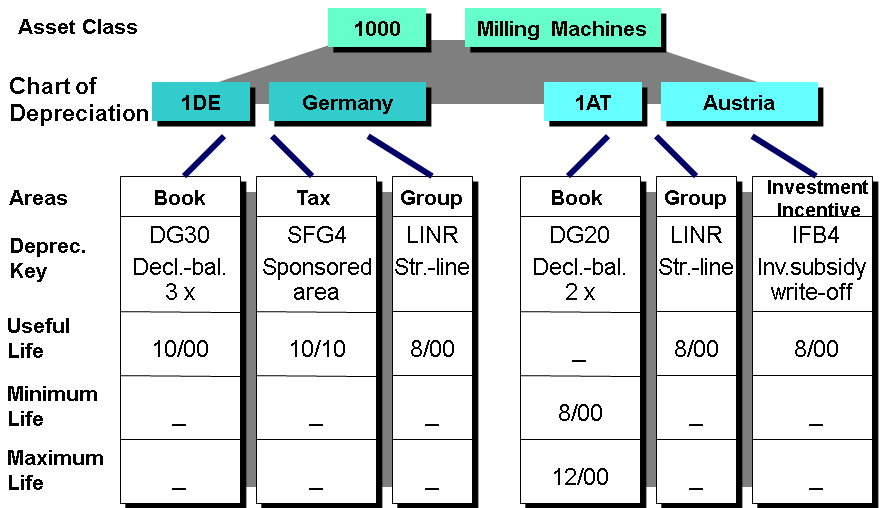

Chart of Depreciation

To manage the depreciation and valuation of assets in accordance with various legal requirements, charts of depreciation are utilized. Typically, these depreciation charts are country-specific and are independently defined from the other organizational entities.

You have to assign each company code defined in Asset Accounting to exactly one chart of depreciation.

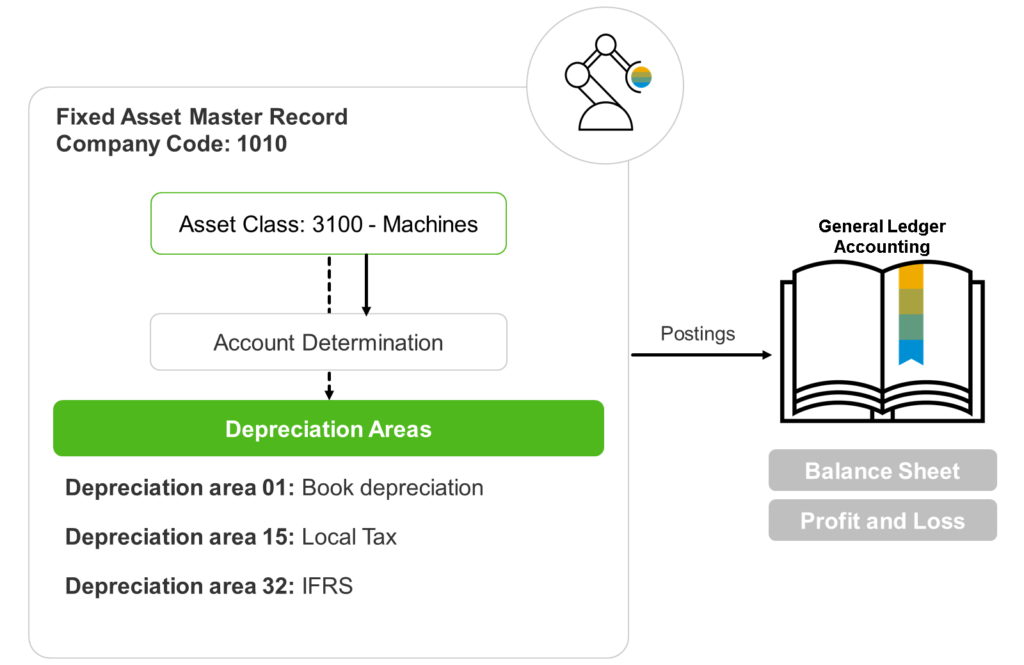

Depreciation Area

In Book depreciation, depreciation is calculated as per the statutory requirements of the corporate laws (for example Indian Companies Act) and As per Income Tax act, depreciation is calculated as per the Income tax laws.

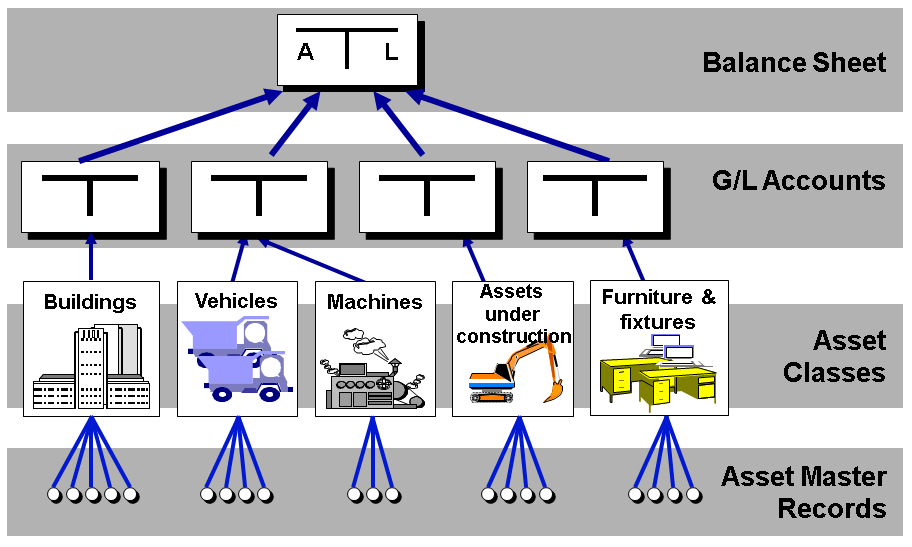

Asset Class

The structure of fixed assets is most effectively done through the use of asset classes. Within the system, you are able to define an endless number of different classes of assets.

Asset Class # Account Determination

One of the most important functions of the asset class is to establish the connection between the asset master records and the corresponding accounts in the general ledger in Financial Accounting. This connection is created by the account determination key in the asset class

Reference : sap.com

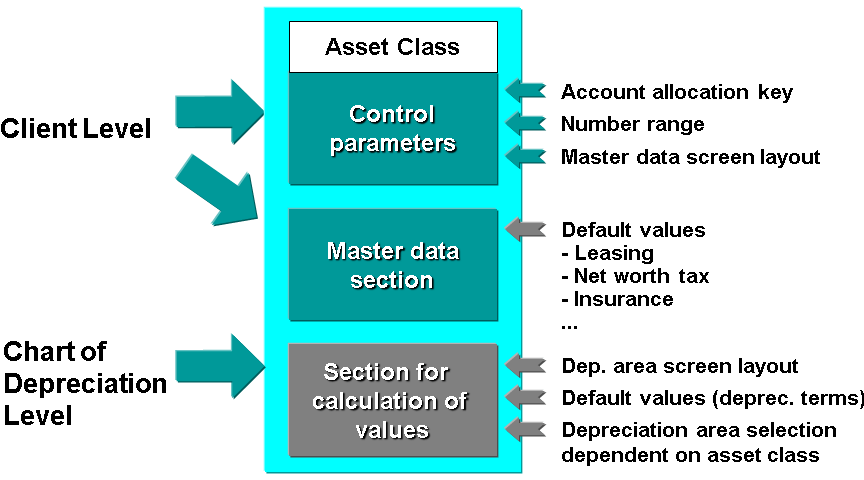

Structure of the Asset Class

Reference : sap.com

Each asset class can have any number of depreciation charts.

Reference : sap.com

Asset Transaction Types

Asset Accounting distinguishes business transactions by category (acquisition, retirement, transfer). It regulates numerous system activities while posting business transactions, determining how the transaction is executed.

Transaction Type on the Posting

| Property | Determination: |

|---|---|

| Account assignment | Capitalize asset Deactivate asset Debit/credit indicator Document type |

| Retirement/transfer | Retirement with revenue Gain/Loss from retirement of fixed assets Transaction type for offsetting entry Acquisition in same fiscal year |

| Other features | Transaction in the past Propose consolidation transaction type Cannot be used manually |

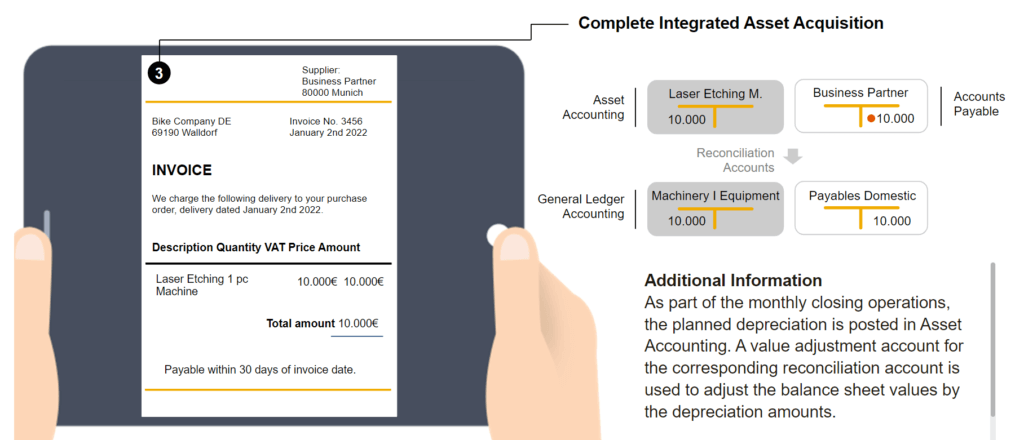

Asset Acquisitions

A purchase of a physical asset from a third party, such as a vendor or supplier, is considered an external asset acquisition. (Contrarily, a purchase is not required to make an acquisition from in-house production.)

When an asset is retired, it is completely withdrawn from use. Assets can be retired through methods like selling them to a third party or getting rid of them because they are obsolete. In order to ensure that the retirement of long-term assets conforms to generally accepted accounting principles, it is important to implement controls over these assets.

Technical clearing account

The technical clearing account serves as a mechanism to support external asset transactions, such as acquisitions from suppliers and sales to customers. The account is recorded in the operational document and is substantiated by the accounting-principle-specific papers, ensuring that it consistently maintains a balanced value of zero following each posting.

Asset value date

The asset value date refers to the date on which the value of an asset transaction is recorded from the perspective of Asset Accounting. The posting amount of a capitalized asset undergoes automatic depreciation calculation with each transaction. The determination of the depreciation start date is mostly influenced by the asset value date, which is adjusted by the period control of the depreciation key.

Default Values for Asset Value Date

The asset value date directly affects depreciation, hence the system sets a default date when possible. The following overview illustrates the default asset value date for key asset transactions:

| Asset Transaction | Default Value for the Date |

|---|---|

| Initial acquisition | Capitalization date from master record (if in same fiscal year, otherwise posting date) |

| Subsequent acquisition in the same year | Asset value date of initial acquisition |

| Subsequent acquisition in later years | Document date |

| Down payment | Capitalization date from master record (if in same fiscal year, otherwise posting date) |

| Investment Support | Capitalization date from master record (if in same fiscal year, otherwise posting date) |

| Revaluation | Date of revaluation measure |

| Credit memo at time of invoice receipt | Value date of the invoice receipt (if in same fiscal year, otherwise posting date) |

| Later revenue/costs from retirement | Date of last retirement (if in same fiscal year, otherwise posting date) |

| Manual value adjustments | First day of fiscal year |

| Retirement/transfer | No default value (required entry) |

| Settlement of asset under construction | Posting Date |

Automatically Set Asset Value Date

In the following posting transactions, asset value dates cannot be entered. The system automatically utilizes the default asset value date.

| Transaction | Default Value for the Date |

|---|---|

| Goods receipt (valuated) | Posting Date |

| Invoice receipt with reference to purchase order (valuated) | Posting date of goods receipt (if in same fiscal year, otherwise posting date) |

| Invoice receipt without reference to purchase order (valuated) | Posting Date |

| Invoice receipt (difference posting) | Posting date of goods receipt |

| Stock withdrawal | Posting Date |

Asset Transfers

Transfers of assets are monetary transactions in which the value of one asset is exchanged for that of another. Both intracompany and intercompany transfers are allowed.

Intracompany Transfers

A fixed asset or asset component can be moved from one asset master record to another via intracompany asset transfer. The transmitting asset and the receiving asset must have the same company code.

Intercompany Transfer

Transferring assets between companies (or between different company codes) is facilitated by this feature. A retirement for one firm and an acquisition for another is what an intercompany transfer looks like from the perspective of the two companies involved. However, from the perspective of the corporate group, this indicates a transfer that, in most cases, results in a zero balance in the company’s asset history sheet.

Transfer Methods

There are three transfer types,

The gross method

The gross method is the most common, in which the historic values of the asset are all transferred to the new asset

| Asset | Acquisition and Production Cost | Accumulated Depreciation |

| Sender | 1000 | 200 |

| Receiver | 1000 |

The net method

The net method transfers the net book value of the sender to the receiver

| Asset | Acquisition and Production Cost | Accumulated Depreciation |

| Sender | 1000 | 200 |

| Receiver | 800 |

The new value method

The new value method capitalizes the new asset at a manually entered revenue amount

| Asset | Acquisition and Production Cost | Accumulated Depreciation |

| Sender | 1000 | 200 |

| Receiver | 700 |

Low-Value Assets

Low-value assets (LVAs) have purchase costs under limitations.Low-value assets (LV As) are always fully depreciated in their acquisition year. Their values aren’t usually reported separately.

Assets Under Construction

Assets under construction are a special form of tangible assets. They are usually displayed as a separate balance sheet item and therefore need a separate account determination in their asset classes.

Assets that are under construction are generally not eligible for ordinary depreciation in the majority of countries. By selecting a depreciation key that prohibits ordinary depreciation in the book depreciation area,

Many (or all) assets under construction should not be managed on one master record. Consider using a general ledger clearing account to temporarily collect acquisitions for under-construction assets.

Depreciation

Depreciation is an accounting technique that is employed to distribute the cost of a tangible or physical asset over its useful lifespan. Depreciation is a measure of the amount by which the value of an asset has been depleted over time. The payment structure enables companies to generate income from their owned assets by spreading out the cost over a specific duration.

The cost of assets, such as machinery and equipment, is high. By utilizing depreciation, companies have the option to distribute the total cost of an asset over multiple years instead of recognizing it entirely in the first year. This allows them to align the expenses associated with depreciation to the corresponding revenues within the same reporting period. The practice of writing off an asset’s value over a specific period, such as its useful life, enables a company to account for the depreciation of the asset over time.

- Straight Line

Straight-line depreciation is a method used in accounting to allocate the cost of a fixed asset evenly over the anticipated period of time that the organization will derive benefits from its utilization. - Sum of Years Digits Depreciation Method

The sum of year depreciation method is a type of accelerated depreciation method. This method involves a faster decline in the value of an asset over time. The majority of an asset’s depreciation is acknowledged during the initial years of its useful lifespan. The initial years of an asset’s life allow for larger deductions compared to later years, particularly for assets that experience significant usage during their early stages. - Units of Production

The value of an asset can vary depending on how it is used. The unit of production depreciation method is commonly employed for assets that experience a greater level of wear and tear. Hence, this practice enables companies to increase their reported depreciation during periods of high productivity, while reducing it during the off-season. - Double Declining Balance

The double declining balance (DDB) depreciation method is a financial accounting technique that allows for the accelerated depreciation of specific assets, resulting in a higher depreciation expense compared to the straight-line method. The depreciation of an asset is typically highest during the initial year of ownership and gradually decreases as time goes on.

Revaluation

Assets A fixed asset may be revalued for a number of reasons, including the sale of the asset to a different business unit, a merger or acquisition of the company, etc., and the resulting change in the carrying value of the fixed asset may be positive or negative, depending on the fair market value of the fixed asset.

Assets Revaluation Methods Indexation Method, Current Market Price Method and Appraisal Method

Impairment

An impaired asset refers to an asset that has been assessed to have a value lower than its book value or net carrying value. To clarify, an impaired asset refers to an asset whose current market value is lower than its recorded value on the balance sheet. In order to address the loss, it is necessary to update the company’s balance sheet to accurately represent the reduced value of the asset.

Asset impairment is a significant decrease in the recoverable amount of an asset, typically occurring suddenly and only once. The causes of various events can range from natural disasters to regulatory changes made by humans, with many other factors playing a role as well.

Disposition

At some point, a company may find that an asset is no longer beneficial due to factors such as inefficiency or other circumstances. The asset should be disposed of.When an asset reaches the end of its useful life, a company has several options for disposing of it, including selling, trading, or scrapping the asset.

During this phase, the assets are removed from the accounting records. The asset disposal transaction during that financial period may result in either a gain or a loss being recorded.